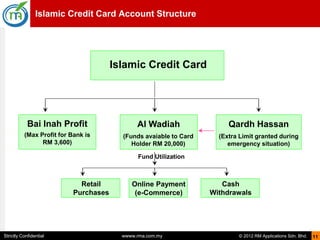

Tell foreign transaction fees non nein noj with these top-rated travel credit cards. The concept of Islamic Credit Card.

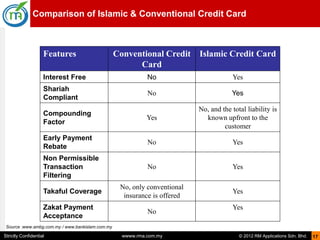

What makes a credit card Islamic is Shariah compliance.

. Respondents were conventional credit card users 220 391 per cent were Islamic credit card users and the remaining 152 277 per cent were using both credit cards. Ad Get Access to the Credit You Need With a Refundable Secured Card DepositApply Today. An Islamic credit card varies from a conventional banking credit card but essentially both cards carry out the same function.

Enjoy Our Quicksilver Secured or Platinum Secured CardNo Hidden Fees. The Islamic and conventional banks could focus on several factors influencing customers selection and could focus to improve certain lacking areas as perceived by the consumers. Islamic Credit Card follows the guidelines of Islamic scholars and help provide a financial solution which brings the best of both the world.

FIN546_GROUP ASSIGNEMNT_MARCH - OGOS 20221. Using an Islamic card also allows you to make upfront purchases. A Credit card is a.

Get Your Loan In 24 Hours. After the launch of Al. Around 10-15 of these people had avoided credit card due to Islamic philosophy.

Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam. AMIRAH BINTI MD ISA 20204766422. The main differences between Islamic credit cards and.

A recent study shows a low level of card penetration in most of the Muslim countries. An Islamic credit card varies from a conventional banking credit card but essentially both cards carry out the same function. Ad Stop paying foreign transaction fees with these top travel-friendly credit cards.

Tally can get you to 0 credit card debt faster. Ad Get Access to the Credit You Need With a Refundable Secured Card DepositApply Today. No interest is charged the Bank is counteracted with a predetermined monthly fee.

Up to 100000 in 24 hrs. Ad Worried About Approval. Islamic credit cards must be Shariah-compliant and free from any type of activity considered unlawful in Islam.

Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam. As mentioned Islamic credit cards are shariah-compliant and conventional credit cards are not. Ad Outsmart credit card companies.

Interest is changeable it relies on the unsettled. Credit card conventional vs islamicnur fatin syahirah 2017726845DEFINITIONCARD CREDITA credit card is a card which allows people to buy items without cash. Enjoy Our Quicksilver Secured or Platinum Secured CardNo Hidden Fees.

Connect With Top Lenders. Ad Compare Top Credit Card Refinancing 2022. The paper Comparison between Islamic Credit Cards and Conventional Credit Cards is a worthy example of a research proposal on finance and accounting.

Being shariah-compliant Islamic credit cards shall not be used for or be part of. MAS MASYURA BINTI JAMAL ZORKAEN 20208285343MUHAMMAD FARID BIN MANEH. The main differences between Islamic credit cards and.

The Islamic and conventional banks could focus on several factors influencing customers selection and could focus to improve certain lacking areas as.

Pdf The Difference Between Conventional And Islamic Credit Card Fatimah Zahrah Zaid Academia Edu

Pdf Viability Of Islamic Credit Card As An Alternative To Conventional Credit Card

A Guide To Getting Your First Credit Card

Pdf Islamic Credit Cards How Do They Work And Is There A Better Alternative

Islamic Credit Cards Do They Bring Shariah Value To The Table Part 1

Islamic Fintech Credit Cards The Bridge Between Conventional And Islamic Banking

Comparison Between Islamic And Conventional Credit Cards

Pdf Credit Cards Preferences Of Islamic And Conventional Credit Card

Pdf Credit Cards Preferences Of Islamic And Conventional Credit Card

Pdf A Study On Islamic Credit Cards Holders